Dublin, June 13, 2025 (GLOBE NEWSWIRE) — The “Consumer Finance – Global Strategic Business Report” has been added to ResearchAndMarkets.com’s offering.

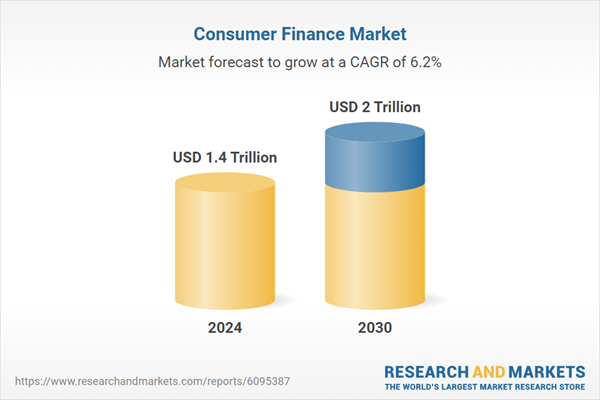

The global market for Consumer Finance was valued at US$1.4 Trillion in 2024 and is projected to reach US$2 Trillion by 2030, growing at a CAGR of 6.2% from 2024 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions. The report includes the most recent global tariff developments and how they impact the Consumer Finance market.

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aiful Corporation, Affirm Holdings, American Express, Ares Management, and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

The growth in the consumer finance market is driven by several factors centered around digital accessibility, behavioral shifts, and ecosystem expansion. A primary driver is the widespread adoption of smartphones and digital payments, which provide the foundation for mobile-based lending, credit access, and financial management. The emergence of embedded finance models across retail, e-commerce, and transportation apps is also expanding consumer access to tailored credit and financial tools at the point of need.

The shift toward cashless economies and real-time payment networks is creating infrastructure support for instant disbursement and repayment, encouraging the growth of short-term credit products like BNPL and microloans. Increased investor interest and venture funding in fintech startups are further accelerating innovation and global expansion of digital finance platforms. Lastly, regulatory initiatives such as e-KYC, PSD2, and financial inclusion mandates are supporting the integration of underserved segments into the formal financial system, creating new demand for accessible, flexible, and technology-enabled consumer finance products worldwide.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Secured Consumer Finance segment, which is expected to reach US$1.3 Trillion by 2030 with a CAGR of a 7.3%. The Unsecured Consumer Finance segment is also set to grow at 4.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $370.1 Billion in 2024, and China, forecasted to grow at an impressive 10.0% CAGR to reach $404.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Consumer Finance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Consumer Finance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Consumer Finance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Some of the 42 companies featured in this Consumer Finance market report include:

- Aiful Corporation

- Affirm Holdings

- American Express

- Ares Management

- Bank of Baroda

- Bajaj Capital

- Capital One Financial

- Cetelem

- Citigroup

- Consors Finanz

- Discover Financial Services

- Equifax

- HDFC Bank

- Home Credit B.V.

- ICICI Bank

- Kotak Mahindra Bank

- L&T Finance

- Muthoot Finance

- Ping An Insurance Group

- SoFi Technologies

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Key Attributes

| Report Attribute | Details |

| No. of Pages | 180 |

| Forecast Period | 2024-2030 |

| Estimated Market Value (USD) in 2024 | $1.4 Trillion |

| Forecasted Market Value (USD) by 2030 | $2 Trillion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

MARKET OVERVIEW

- Influencer Market Insights

- World Market Trajectories

- Tariff Impact on Global Supply Chain Patterns

- Consumer Finance – Global Key Competitors Percentage Market Share in 2025 (E)

- Competitive Market Presence – Strong/Active/Niche/Trivial for Players Worldwide in 2025 (E)

MARKET TRENDS & DRIVERS

- Accelerated Digitalization of Banking and Financial Services Throws the Spotlight on Tech-Enabled Consumer Finance Platforms

- Rising Smartphone Penetration and Internet Access Drives Adoption of Mobile-First Lending and Payment Solutions

- Expansion of Buy Now, Pay Later (BNPL) Models Spurs Consumer Engagement in E-Commerce and Retail Spending

- Growth in Financial Inclusion Initiatives Supports Credit Access for Unbanked and Underbanked Populations

- Integration of AI and Big Data Analytics Enhances Risk Scoring, Personalization, and Fraud Detection in Consumer Finance

- Technological Advancements in Biometric Verification and E-KYC Streamline Onboarding and Fraud Prevention

- Surge in Demand for Instant Loan Disbursals and Flexible Repayment Drives Development of Real-Time Underwriting Engines

- Growing Popularity of Robo-Advisors and Automated Savings Tools Broadens Scope of Digital Wealth Management

- Rise of Embedded Finance and API-Based Lending Expands Financial Access at the Point of Transaction

- Increasing Adoption of Digital Wallets and Contactless Payments Blurs the Lines Between Banking, Lending, and Commerce

For more information about this report visit https://www.researchandmarkets.com/r/8q0vdo

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

- Consumer Finance Market

发表回复