US market numbers in March from Circana; Adjust shared mobile insights report, new VC market report by Konvoy.

Reports of the week:

-

Adjust: Mobile Games Insights Report (2025)

-

GameDiscoverCo: Competition landscape for new games on Consoles and Steam

-

Konvoy VC: Gaming Investments in Q1’25

-

StreamElements & Rainmaker.gg – Streaming on Twitch in March 2025

-

DFC Intelligence: Nintendo Switch 2 potential analysis

-

Games & Numbers (April 9 – April 22, 2025)

-

Kickstarter: 2024 set a record for the number of successful crowdfunding campaigns in video games on the platform

-

Newzoo: Top 20 PC/Console Games by Revenue and MAU (March’25)

-

Circana: The U.S. Gaming Market in March 2025

Adjust: Mobile Games Insights Report (2025)

The data for this study covers the period from January 2023 to March 2025. The study included more than 5,000 apps.

General market details

-

By the end of 2024, mobile devices account for 49% of all gaming revenue. Consoles make up 28%, and PC accounts for 27%.

-

Game app downloads in 2024 grew by an average of 4% YoY. Growth leaders are MENA (+10% YoY), LATAM (+8% YoY), and APAC (+4% YoY). Downloads are declining in Europe (–1% YoY) and North America (–11% YoY).

❗️Previously, Sensor Tower released a report stating that global game downloads fell by 6%.

-

The number of sessions decreased by 0.6%. Only Latin America (+7% YoY) and the MENA region (+5% YoY) showed growth.

-

ATT Opt-in in games in Q1’25 increased to 37.9% from 37.5% in Q1’24. The growth, however, is barely noticeable. The best rates are in arcade games (59.3%), sports projects (54.1%), and action games (45.9%). ATT opt-in is not growing in all genres—some are declining (for example, Idle RPG).

-

By region, Indonesia leads in ATT opt-in (58.6%), followed by Malaysia (51.9%), and Thailand and Brazil (both at 51.4%). In the US, this figure is 32% and has not changed over the past year.

Installs, Sessions, and Retention trends

-

In 2024, hyper-casual games continue to lead in a share of installs—accounting for 27% of all downloads. Puzzle and hybrid-casual projects each account for 11% of downloads.

-

By number of sessions, action games lead (21%), followed by puzzles and hyper-casual projects (11% each).

-

Strategy game downloads in 2024 grew by a significant 83%. The number of sessions also increased by 17%. Adjust also notes growth in RPG downloads (+32% YoY) and simulators (+25% YoY). The biggest drops in downloads were in kids’ games (–30% YoY) and sports projects (–28% YoY).

-

Among countries, the largest growth in downloads is seen in Indonesia (+21% YoY), Turkey (+10% YoY), and Mexico (+8% YoY). However, most regions are declining by session numbers.

-

The share of re-attribution in 2024 averaged 0.02. For every 100 installs, 2 are re-attributions.

❗️There is a typo on the chart on the left—it should be 0.02, not 0.05.

-

The ratio of paid to organic traffic increased from 2.11 in 2023 to 2.18 in 2024. For every 100 organic users, there are now 218 paid users.

-

The strongest growth is in Mexico and Latin America overall—from 3.7 in 2023 to 4.32 in 2024. India is one of the few global regions where organic share increased (the ratio dropped from 3.82 in 2023 to 3.14 in 2024).

-

The average game session length in 2024 was 30.75 minutes—slightly higher than last year. The longest game sessions are in Indonesia (just over 45 minutes).

-

The median number of sessions by players immediately after installing a game (on Day 0) decreased from 1.66 in 2023 to 1.64 in 2024. Hyper- and hybrid-casual projects lead (1.82 sessions).

-

Average D1 Retention across all genres worldwide dropped from 28% to 27%. The average D30 for the market was 5%.

❗️All “average” metrics should be treated with skepticism.

UA Trends

-

IPM (Installs per mile) among game apps increased from 8.1 in 2023 to 8.86 in 2024. The highest IPM is in racing games (24.99 in 2024) and music games (14.41).

-

By region, the highest IPM is in the MENA region (11.56 in 2024). North America is second (11.11).

-

CPC among game apps in 2024 remained at a median level of $0.03. The cost dropped significantly for Idle RPG (from $0.43 to $0.24), and RPG (from $0.25 to $0.08)—which should indicate reduced competition in these genres. Interestingly, CPC also fell among strategy games (from $0.11 to $0.04)—despite growth in downloads and seemingly increased competition in the genre.

-

The highest CPC is in North America—and the US—at $0.08.

-

The average CPI in games dropped from $0.38 in 2023 to $0.36 in 2024. At the same time, CPI for hyper-casual games rose to $0.4; hybrid-casual almost doubled—to $0.95.

-

Record average CPI is in Singapore—$1.35. Also leading are North America ($1.2) and the DACH region ($1.2).

-

The average CTR of game creatives increased from 7% to 9%. The biggest increase was in racing games (from 18% to 26%). But the leader is hybrid-casual projects (CTR—28%).

-

The highest CTR is in Japan (15%), followed by the US (14%).

-

Median CPM dropped to $3.41 in 2024. The biggest growth is in casino (from $8.01 in 2023 to $10.97 in 2024).

-

By country, the highest CPM is in the US ($16.21—in 2023 it was $15.66). Overall, CPM growth is seen in almost all regions in 2024. Declines are seen in some Asian countries and in Europe.

User revenue trends

-

In 2024, median ARPM (ad revenue per mile) decreased in most categories. The biggest drop was in board games (from $2.13 in 2023 to $0.75 in 2024). Adventure games also saw a significant drop (from $6.97 to $4.22).

-

Declines are also noticeable in almost all regions. A significant drop in the US (from $6.76 in 2023 to $4.71 in 2024), in the APAC region (from $2.2 to $1.57).

-

ARPMAU also dropped from $0.31 in 2023 to $0.28 in 2024. However, the metric grew significantly in casino (from $1.39 to $1.92) and in strategy (from $0.86 to $1.18).

-

In almost all countries worldwide, ARPMAU fell in 2024. The exception is the MENA region (growth from $0.15 in 2023 to $0.19 in 2024).

-

IAP ARPMAU (IAP average revenue per monthly active user) fell from $0.83 in 2023 to $0.58 in 2024. According to Adjust, strategy games grew significantly (from $2.6 to $5.34); RPGs also increased (from $5.36 to $6.48). The biggest drop was in board games—from $0.74 to $0.3.

❗️Previously, Sensor Tower reported that RPG IAP revenue fell by 17.3% in 2024. The data does not match. It’s a matter of sample and methodology.

-

All regions showed a decline in IAP ARPMAU in 2024. People are spending less—most likely due to economic instability.

Source

GameDiscoverCo: Competition landscape for new games on Consoles and Steam

DAU Distribution on consoles and Steam

-

On PlayStation, the top game by DAU (Fortnite) accounts for 14.3% of the platform’s total DAU.

-

The top 5 projects make up 43% of total DAU; the top 50—76.7%; the top 100—84.2%.

-

The situation on Xbox is a bit better. Fortnite (again the top game) takes up 9.8% of the platform’s total DAU.

-

The top 5 projects have 35.5% DAU; the top 50—67.3%; the top 100—76%. It’s possible that Game Pass helps people discover more projects.

-

On Steam, the top game by DAU (Counter-Strike 2) has 10.7% of the platform’s total DAU.

-

But the top 5 have 26.7%, and the top 50 projects—50%. The top 100 projects have 59.9% DAU.

-

The chart shows that PlayStation is the most consolidated platform in terms of audience. Users are concentrated around the same projects. The Steam audience, on the other hand, is more diversified across projects.

❗️Simon correctly notes that for many projects, DAU is not a key metric. In particular, for premium products, this metric is less important.

-

If you look at DAU distribution, Steam is the platform where it’s easiest to get user attention.

Successful Launches of New IPs on Different Platforms

Sales estimates by GameDiscoverCo. Nintendo Switch physical copies sales are not included.

-

In 2024, 1,115 games were released on Xbox, of which 29 (2.6%) crossed the 100,000 copies sold mark. Only 8 games (0.72%) are new IPs.

-

Of the 1,292 games released on PlayStation in 2024, 63 (4.88%) sold more than 100,000 copies. 18 (1.39%) are new original projects.

-

On Nintendo Switch in 2024, 2,898 new games were released, 36 (1.24%) sold over 100,000 copies. And only 15 (0.52%) are new IPs.

-

And finally, Steam. Of 19,003 new games, 233 surpassed 100,000 copies sold (1.23% of the total). 147 of them (0.77%) are new original projects.

-

In absolute numbers, Steam is the clear leader in the number of projects that reached 100,000 copies sold in the first year. The platform also leads in the number of new IPs that hit this mark.

-

But if you look at relative numbers, the highest chance of success, surprisingly, is on PlayStation. Statistically, that’s the case, but in reality, Steam is the main platform for new successful games thanks to its algorithmic featuring system. Steam has a very low entry barrier for new developers (unlike consoles), and 75% of projects don’t even have 50 reviews, which affects the data.

-

The GameDiscoverCo team also compiled a list of projects that made it into the list of successful new IPs on consoles—Animal Well, Another Crab’s Treasure, Balatro, Black Myth: Wukong, Grounded, Hypercharge: Unboxed, Little Kitty Big City, Metaphor: Refantazio, Phasmophobia, Rise Of The Ronin, Sker Ritual, Stellar Blade, Stray, Undisputed, Unicorn Overlord, V Rising.

Source

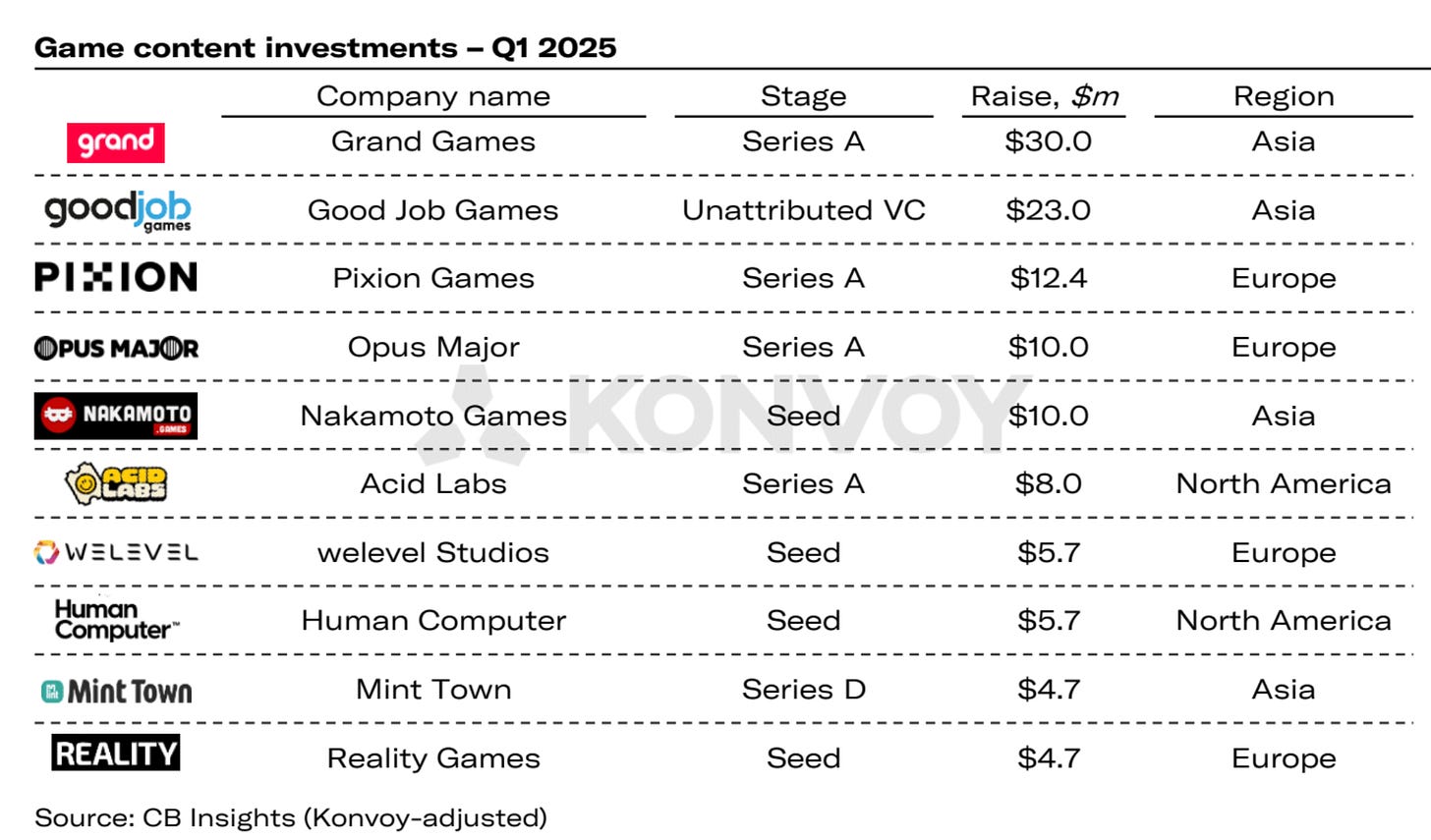

Konvoy VC: Gaming Investments in Q1’25

Konvoy VC’s report includes deals with both gaming technology companies and content producers. The list of deals also features companies that many wouldn’t consider strictly gaming (for example, Underdog Fantasy Sports—a fantasy sports platform).

Correction: In a previous publication, I mentioned that GameDiscoverCo is not tracking PlayStation/Xbox physical sales. It is. The only blind spot is Nintendo Switch physical sales. Thanks to Simon’s hawk eye, now it is fixed!

General industry overview

-

In 2025, the gaming market is expected to reach $186.1 billion. Market growth is slowing down.

-

The number of gamers worldwide reached 3.422 billion in 2024. The majority (53%) are in the Asia-Pacific region.

-

The US and China account for 27% of the global gaming base but generate 52% of all industry revenue in 2024.

Investment Climate

-

Private investments in Q1’25 totaled $700 million, a 23% increase compared to the previous quarter.

-

In Q1’25, there were 77 venture deals totaling $373 million. This is a 35% increase in deal value but a 6% drop in deal count compared to the previous quarter.

-

Growth-stage investments (Series B–D) increased by 125%. However, most investment activity still happens on early stages.

-

The number of deals has been declining since Q1’24. The Q1’25 figure is the lowest since early 2021.

-

Gaming ETFs for public companies grew by 4.8% (ESPO) and 6.2% (HERO) in Q1’25. The S&P 500 fell by 5.4% during the same period.

-

Public gaming companies hold $36 billion in cash or equivalents. Including tech companies interested in games, this figure is much higher.

-

Asian firms are the leaders in cash reserves among gaming companies.

-

There were 43 public company-related transactions in Q1’25—a record since 2022. Most deal values were undisclosed.

-

The largest Q1’25 gaming tech/platform deals: Underdog ($70M—Series C), Halliday ($20M—Series A), and SlingShot DAO ($16M—Series A).

❗️Underdog is a fantasy sports platform. Halliday is a blockchain platform for app development. SlingShot DAO is an AI launcher for Roblox with Web3 integration. Whether these count as gaming companies is debatable.

-

Top content company deals: Grand Games ($30M—Series A), Good Job Games ($23M), Pixion Games ($12.4M—Series A).

Regional Investment Breakdown

-

North America ($198 million) continues to lead in venture investment volume in Q1’25.

-

Asia leads in deal count (33 deals).

-

From 2021 to Q1’25, the US outpaced China in gaming venture investment volume by 7.6x. The deal count difference is similar.

❗️Konvoy VC only tracks publicly announced deals. In China, public deal announcements may be less frequent or stay within the local market.

-

Business activity has slowed significantly in all regions. In recent quarters, there have been no deals in Africa, Australia, or South America.

Source

StreamElements & Rainmaker.gg – Streaming on Twitch in March 2025

-

Total viewership in March increased to 1.686 billion hours.

-

However, daily hours watched in March dropped to late 2024 levels—down to 54 million per day.

-

The top of the streaming charts remains stable: Grand Theft Auto V (88 million hours), League of Legends (87 million hours), and Counter-Strike 2 (78 million hours).

-

Monster Hunter: Wilds broke into the top 10, debuting at 9th place (8th if you exclude the Just Chatting category), with viewers watching 36 million hours in a month.

-

Marvel Rivals made the top 10 for the fourth month in a row. Despite a decline in watch hours (32 million in March, down 16% year-over-year), the game continues to post strong numbers.

Source

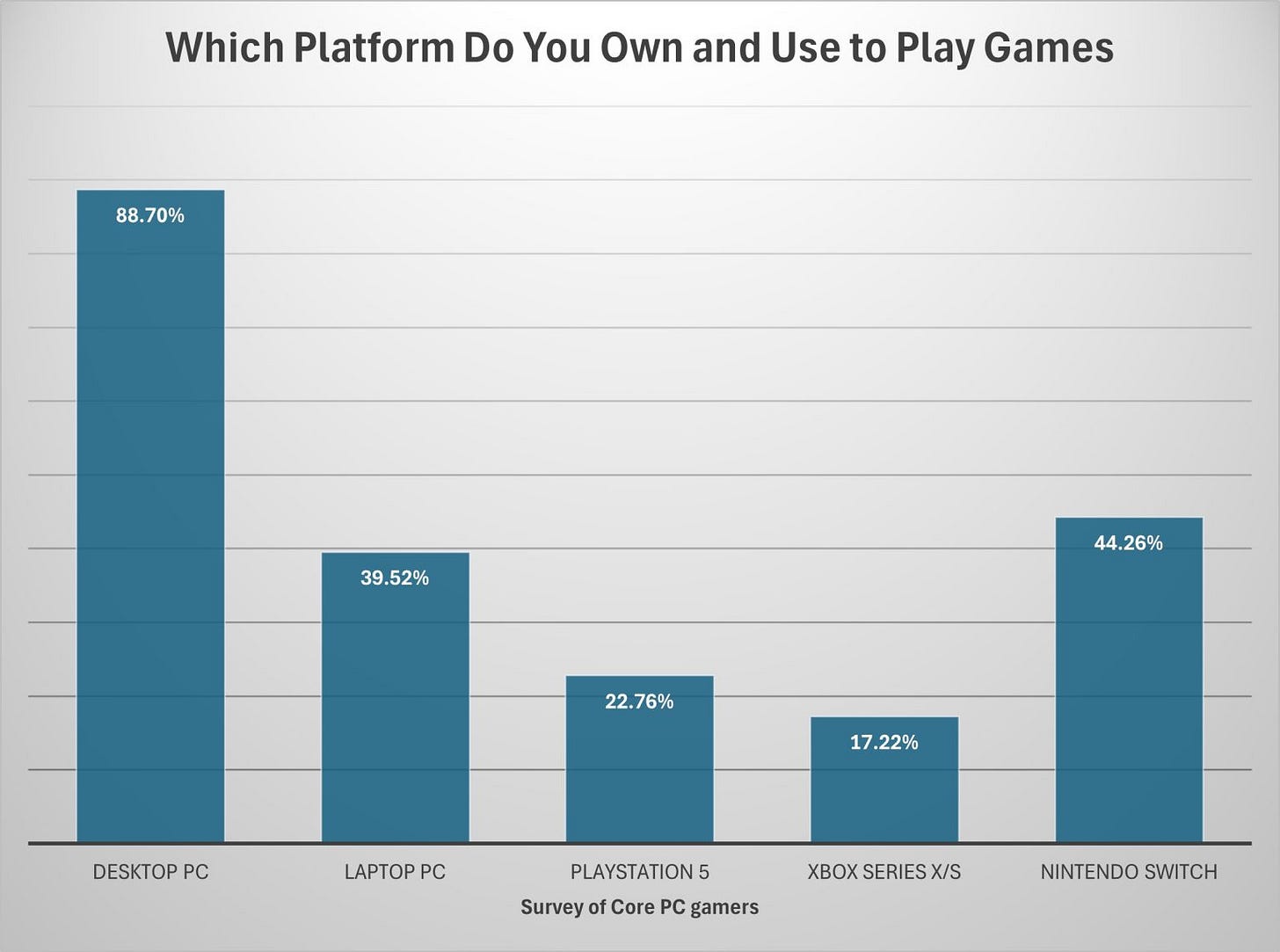

DFC Intelligence: Nintendo Switch 2 potential analysis

The company surveyed two user groups—high-end PC users and PlayStation/Xbox owners. They found out which systems these users also own, besides their main ones, and conducted an in-depth survey with 600 participants.

-

Among high-end PC owners, 55% were over 35 years old. 44% of this audience owns and actively uses a Nintendo Switch as a secondary platform. Despite PC being their primary platform, they value the Nintendo Switch for its portability and exclusives. Owners of both gaming PCs and PlayStation 5 are rarer, at 23%.

-

Out of more than 1,000 surveyed PlayStation and Xbox owners, 83% said they play on two or more platforms at least once a week. 67% play on Nintendo Switch.

-

61% of surveyed PlayStation and Xbox owners have a positive attitude toward Nintendo Switch 2.

-

DFC Intelligence forecasts a 20% price increase for Nintendo Switch 2 in the US within two years after launch.

❗️The forecast was made before Nintendo’s official announcement that the US launch price would remain unchanged.

-

Company specialists do not consider game prices a major issue. They note that a flexible pricing policy will allow Nintendo to satisfy its audience.

-

However, DFC Intelligence, in light of pricing, has lowered its Nintendo Switch 2 sales forecast from 17 million units to 15 million in 2025.

-

If the forecast comes true, Nintendo Switch 2 will become the fastest-selling console in history. DFC Intelligence notes that the system has a chance to outsell the original Nintendo Switch.

Source

Games & Numbers (April 9 – April 22, 2025)

PC/Console Games

-

Star Citizen funding has exceeded $800 million. More than 5.6 million people have participated in the campaign.

-

Sandbox VR has brought developers over $200 million. In 2024 alone, the project earned $75 million.

-

Dwarf Fortress has surpassed 1 million copies sold on Steam. The game launched in December 2022.

-

Frostpunk 2 sold 592,000 copies by the end of 2024. The current number is likely higher.

-

The creators of Delta Force reported that the project’s DAU reached 12 million and continues to grow. They shared this on the Chinese version of their website, so these numbers may refer only to players from China.

-

Ubisoft shared that more than 40 million people have played Assassin’s Creed Origins and Assassin’s Creed Odyssey. Each title reached this milestone.

-

Peak concurrent players in RuneScape: Dragonwilds on Steam reached 52,600. The co-op survival game was well received by the audience, with a rating above 80%.

Mobile Games

-

Metacore reported that Merge Mansion has earned over $600 million and has been downloaded more than 60 million times.

-

Idle games from SayGames have generated over $300 million in revenue.

-

In honor of Elvenar’s tenth anniversary, InnoGames revealed project stats: 26.2 million players and over €200 million in lifetime revenue.

-

After the release of the Minecraft movie, the game set a three-year record for daily revenue—$969,000 on April 12. 2025 has started well for the project overall: the mobile version earned $42.3 million in the first three months, up 34% year-over-year.

-

mo.co from Supercell earned $1.88 million in its first month after release (net of commissions and taxes). The game was downloaded 3.11 million times. However, the revenue trend is negative. Data from AppMagic.

-

Bleach: Brave Souls, just before its 10th anniversary, hit an impressive milestone of 100 million installs.

Transmedia

-

The Minecraft movie has grossed over $550 million worldwide. In the US, the film made $281 million. It is one of the most successful video game adaptations in history.

Kickstarter: 2024 set a record for the number of successful crowdfunding campaigns in video games on the platform

-

Since 2009, 93,756 crowdfunding campaigns for games have been launched on the platform.

-

Users have pledged over $2.63 billion to various game projects. The total number of crowdfunding participants exceeds 23 million.

-

In 2024, more than 70% of backers who supported game projects also backed projects in other categories.

Tabletop Games Results

-

Kickstarter remains the largest crowdfunding platform for tabletop games. In 2024, 83% of all game pledges went to tabletop games.

-

A total of 6,646 campaigns were launched, 5,314 of which were successfully funded. Success Rate – 80% – the highest in the 15-year history of the service.

-

People invested $220 million in successful tabletop game campaigns.

-

The most successful launches of the year: Brandon Sanderson’s Cosmere RPG (raised over $15.1M), Altered TCG by Equinox (raised over $6.7 million), and Trench Crusade by Factory Fortress Inc (raised over $3.3 million).

Video Games Results

-

In 2024, successful video game campaigns raised $26 million. This is 28% more than in 2023.

-

There were 441 successful campaigns in 2024. This is a 9% increase over the previous year. Moreover, this is the largest number of successful game campaigns in Kickstarter’s 15-year history.

-

In 2024, 78% of all game campaigns that raised over $100,000 were launched on Kickstarter

Source

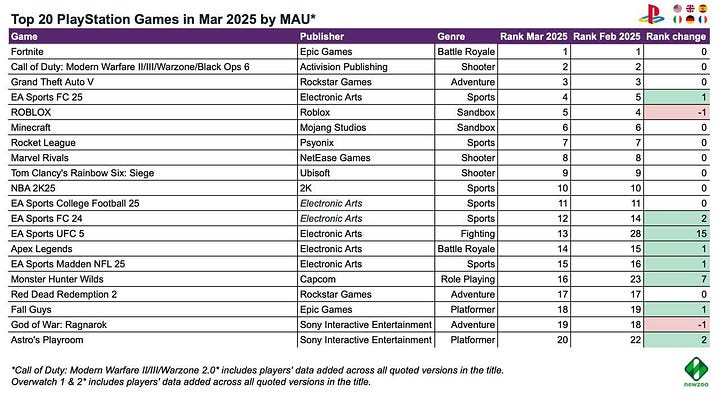

Newzoo: Top 20 PC/Console Games by Revenue and MAU (March’25)

Newzoo tracks the markets of the US, UK, Spain, Germany, Italy, and France.

Revenue – All Platforms

-

Fortnite, Assassin’s Creed Shadows, and EA Sports FC 25 led March revenue in the analyzed regions.

-

Six new projects entered the top revenue chart. Three are franchise titles (Assassin’s Creed Shadows, MLB The Show 25, WWE 2K25), and three are new IPs (Split Fiction, Schedule I, and InZOI).

-

Marvel Rivals, despite a strong start, is rapidly losing ground. The game dropped to 18th place in the revenue chart (last month it was 7th).

-

R.E.P.O. showed the most notable revenue growth—a co-op horror game released at the end of February that gained significant popularity in March.

Revenue – Individual Platforms

-

The top-selling PC projects were Monster Hunter Wilds and Sid Meier’s Civilization VII. Other new entries in the ranking include Kingdom Come: Deliverance II, Avowed, and, surprisingly, The Sims 2 Legacy Collection.

-

Sid Meier’s Civilization VII had a strong start on PlayStation, debuting at 13th place. Also noteworthy is Destiny 2’s return to the top 20.

-

On Xbox, the picture is similar—five new releases in the ranking (Monster Hunter Wilds (formally released in February), Kingdom Come: Deliverance II, PGA Tour 2K25, Avowed, and Sid Meier’s Civilization VII).

-

On Nintendo Switch, only one new game made the top 20—Sid Meier’s Civilization VII. Interestingly, in the sales rankings, the top spots weren’t Nintendo titles, but Fortnite and… Hello Kitty Island Adventure.

MAU – All Platforms

-

The only significant change in overall MAU rankings is R.E.P.O. entering the top 20 (the game debuted at 12th place).

-

On PC, the top 20 included the aforementioned R.E.P.O., Schedule I, and FragPunk.

-

On Xbox, there are two new entries in the top 20 by MAU—Assassin’s Creed Shadows and Atomfall.

-

No major changes on PlayStation and Nintendo Switch.

Source

发表回复