The legislature’s Finance, Revenue and Bonding Committee approved bills Tuesday that would reduce Connecticut transportation construction debt and would gradually phase out property taxes on motor vehicles — in the 2030s.

But even with that long-range strategy, the property tax phase-out faces an uphill struggle, having sparked objections from Gov. Ned Lamont’s administration and from the Connecticut Conference of Municipalities.

The Democratic-controlled finance panel, which must complete action on all its bills by the close of business Thursday, is expected to take up several revenue proposals Wednesday, including a new measure to create a state income tax credit for low- and middle-income families with children.

Those revenue bills, along with a spending plan adopted Tuesday by the Appropriations Committee, will form a blueprint to guide final negotiations with legislative leaders and Lamont on a new state budget for the next two fiscal years.

Capping transportation reserves and paying down debt

One bill, enacted with bipartisan support Tuesday, would cap reserves in the budget’s Special Transportation Fund at 18% of the STF. Any other unspent dollars would be used to pay down transportation debt.

Based on a proposal from state Treasurer Erick Russell, the measure stems from large surpluses in recent years in the transportation fund, which represents about 9% of the $26 billion overall state budget. Besides covering operating expenses for transit programs and for the Departments of Transportation and Motor Vehicles, the fund also pays the debt service — principal and interest — on the hundreds of millions of dollars Connecticut borrows annually for highway, bridge and rail construction projects.

The STF, which gets most of its funding from sales and fuel tax receipts, finished with surpluses approaching or surpassing 10% in each of the past three fiscal years, and the Lamont administration projects a $159 million or 7% surplus this fiscal year.

The STF reserve, which holds these annual surpluses, swelled beyond $970 million last June, according to the state comptroller’s annual reports, a cushion larger than 45% of last year’s entire transportation fund.

Gasoline station owners and fuel distributors began to press state officials to cut gasoline taxes or provide some other relief, given the huge unused revenues.

Legislators agreed to last spring to use $534 million of the reserve to pay down transportation borrowing early — a move Russell projects will save Connecticut $680 million in interest costs over the next decade.

Tax phase-out faces strong objections

The bill approved by the finance committee would maintain the 18% cap permanently and continue to use excess reserves to pay down construction debt.

Majority Democrats adopted a second measure Tuesday over Republican objections that would gradually phase out property taxes on motor vehicles, a levy that generates nearly $1 billion annually for cities and towns.

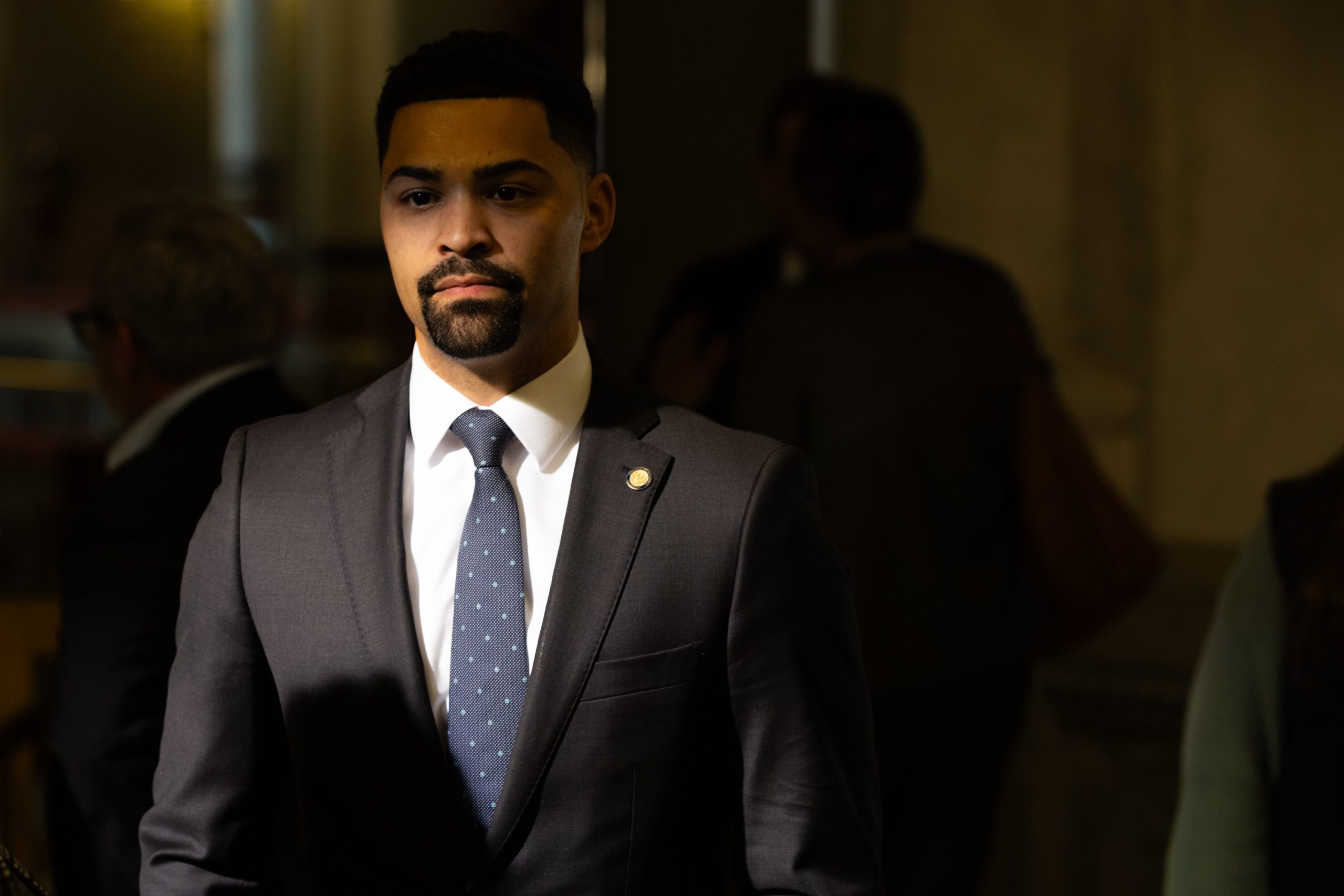

But “there will be no revenue loss to the towns,” said Sen. John Fonfara, D-Hartford, co-chairman of the finance committee.

That plan to keep towns whole hinges on state government continuing to rack up the huge budget surpluses it has averaged since new fiscal caps were established in 2017. The average cushion has been $1.8. billion or 8% of the General Fund.

Legislators have used those surpluses over the past eight years to build the rainy day fund and to make more than $8.5 billion in supplemental pension payments, in addition to the more than $3 billion in required pension contributions it makes annually.

Extra pension payments generate more earnings and slow the growth of the mandatory payments. Lamont’s budget office estimates the state will save $700 million annually on required payments next fiscal year because of all the surplus dollars its dedicated to the pensions since 2020.

But what if those large surpluses and extra pension payments continue in the future? The phase-out bill says that, starting in 2028, any savings on required pension contributions should be redirected toward eliminating the property tax.

For example, if $100 million in pension savings is achieved, and towns are still collecting $1 billion in property taxes, then the state would have communities reduce that burden to $900 million — and send cities and towns $100 million to offset their revenue loss.

Fonfara conceded this process likely would take many years, but the state has been successfully building big surpluses since 2017.

That savings system, though, has come under increasing criticism from majority Democrats in the House and Senate, who say it has left too few dollars to invest in education, health care, town aid and other core programs.

Sen. Ryan Fazio of Greenwich, ranking Senate Republican on the finance committee, said called the municipal levy on motor vehicles “a burdensome tax, an annoying tax, a stupid tax.”

But Fazio, who joined Republicans in voting against the bill, said it hinges on making payments to towns that would be outside of the normal budget process, including the spending cap.

Lamont’s budget director, Jeff Beckham, expressed similar concerns in testimony before the committee.

And the Connecticut Conference of Municipalities, which has long argued that the state relies too heavily on property taxes to fund services at the local level, said any plan to end motor vehicle taxes should be part of a more comprehensive reform that gives communities other options for raising revenue.

The municipal lobbying group also has charged, on many occasions, that state government often reneges on pledges to transfer funds to cities and towns, leaving local property taxpayers in the lurch.

“This bill does not reduce the current revenue needs of towns and cities but shifts the burden to the state and makes towns and cities more dependent,” CCM wrote in its testimony.

Other bills adopted Tuesday by the finance committee would:

- Establish a 25% tax credit, capped at $500, for businesses that contribute to employees’ Connecticut Higher Education Trust account.

- Create business and income tax credits for farming businesses that invest in certain machinery and buildings. The credit is equal to 20% of the amount farmers spend. The measure also would increase the exemption from municipal property taxes for farm machinery from $100,000 of assessed value to $250,000.

- Expand the types of businesses that may earn a state tax credit for making student loan payments on behalf of their employees starting in 2026. The state caps this program and does not issue more than $10 million in credits per year.

- Authorize up to $30 million in borrowing in each of the next two fiscal years to create a new program to help municipal school districts renovate or repair public school buildings, grounds and other infrastructure.

- Establish a $500 state income tax credit for owners of a licensed family child care home starting in 2026.

- Allow cities and towns, starting in October, to expand an existing property tax abatement program for police, firefighters and emergency medical technicians killed in the line of duty. The benefit would also become available to surviving domestic partners of these first responders. The measure also creates a $2,000 state income tax deduction for certain payments to volunteer firefighters and emergency medical service providers.

- Require telecommunications companies to charge subscribers a five-cents-per-month fee to support a cancer relief account for Connecticut firefighters starting in October. Nonpartisan analysts project the fee would generate between $2.4 million and $3 million annually.

发表回复